Account Opening Experience

Company: Fifth Third Bancorp

Sector: Finance

Role: Research to conception, visualization and testing

Overview

Fifth Third Bank is a traditional financial institution seeking to rival the financial technology sector by creating a best-in-class account opening experience. An experience that is simple, quick, and easy to use while ensuring secure access for the customer.

Through this case study, you will see how we carefully considered each portion of the account opening experience and how we strive to create the best user-focused experience.

Discover

Stakeholder Interviews

Once the Product team was stood up to rethink the digital online account opening experience we needed to understand each stakeholder's vision. Through Stakeholder interviews, we were able to gather information and utilize these insights to set the appropriate goals and priorities for the experience.

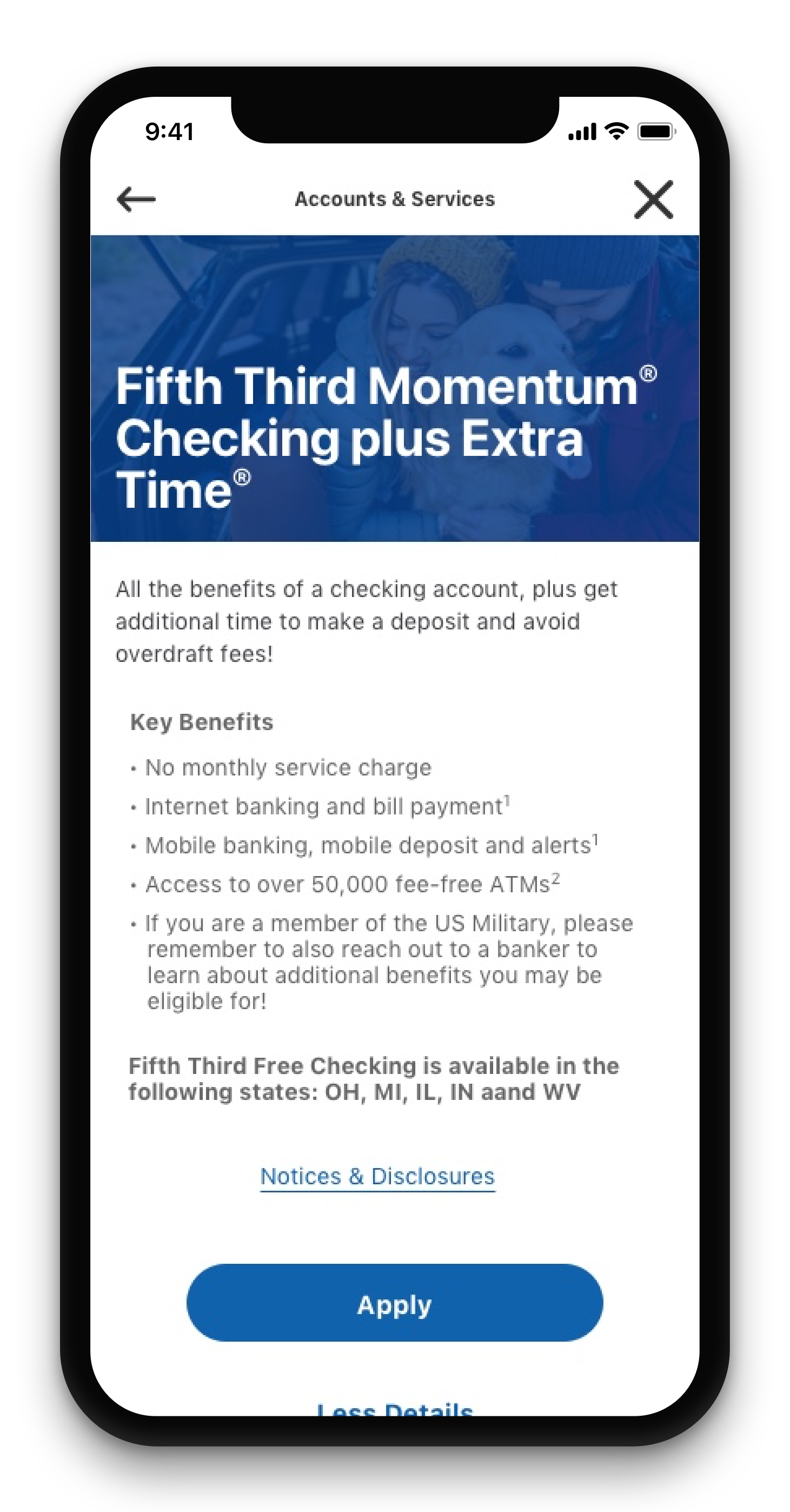

01. We want to enable our users to be able to make informed decisions about the products they are applying for as well as help them understand other products that can help them achieve financial success.

02. We want to streamline the length of the account opening process. Industry leaders are getting their account opening experience down to less than 5 minutes, how can we begin to be competitive with this?

03. As a bank we have been very diligent in fighting fraud and protecting our customers. Account Opening is an area where we can improve on identifying fraudsters early. We want to create a flow that enables early fraud detection.

04. We know that our data says customers with higher fund rates tend to have more accounts and longer relationships with the bank. How might we create an experience that helps users trust us and feel comfortable with funding their new accounts with more money?

Heuristic Evaluation

Once we conducted our stakeholder interviews to understand their vision for the account opening experience, we wanted to conduct a heuristic analysis on the current account opening experience. This enabled us to quickly understand where there were gaps and opportunities to move forward.

Research

Once we had an idea of where there might be opportunities to improve, we interviewed 8 users to start to understand their behaviors, pain points, and goals. We also conducted secondary research to see what others in the industry have learned in similar experiences.

Competitive Analysis

Along with secondary research, we conducted a thorough competitive analysis to understand how our competitors are responding to user’s needs.

Define

Opportunities

Through our stakeholder interviews, competitive analysis, and user interviews we were able to identify four key opportunities.

Opportunity #1

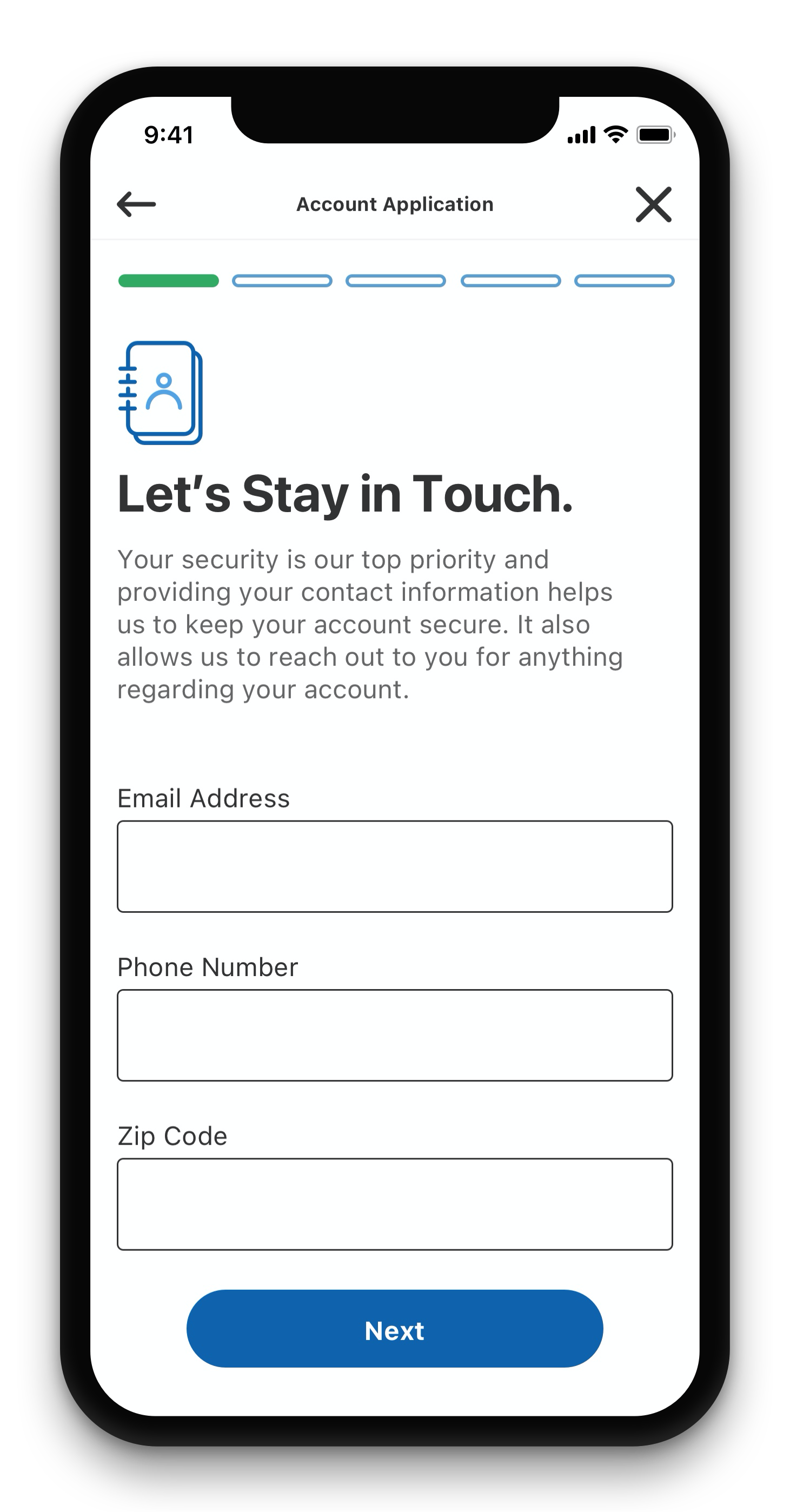

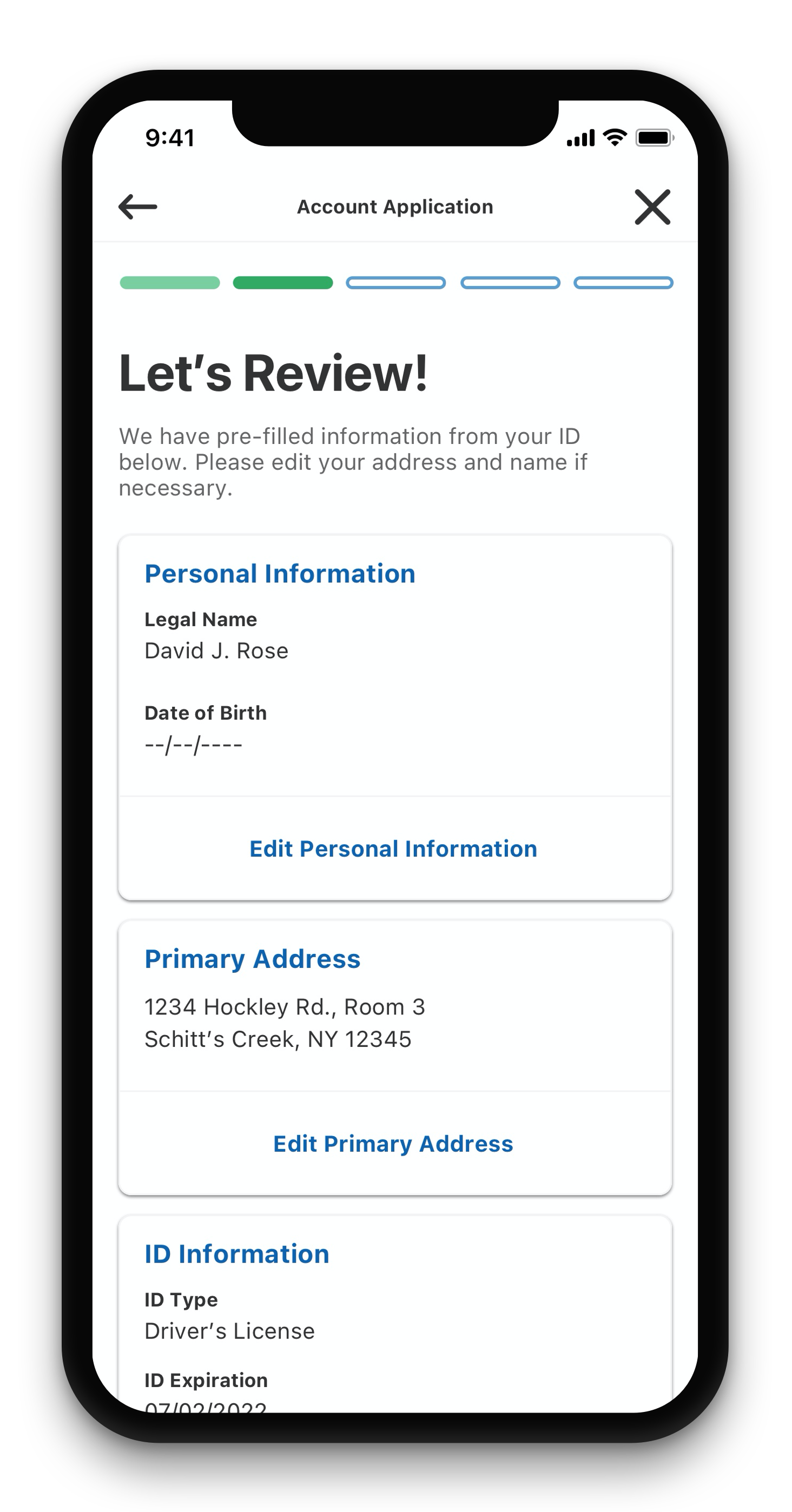

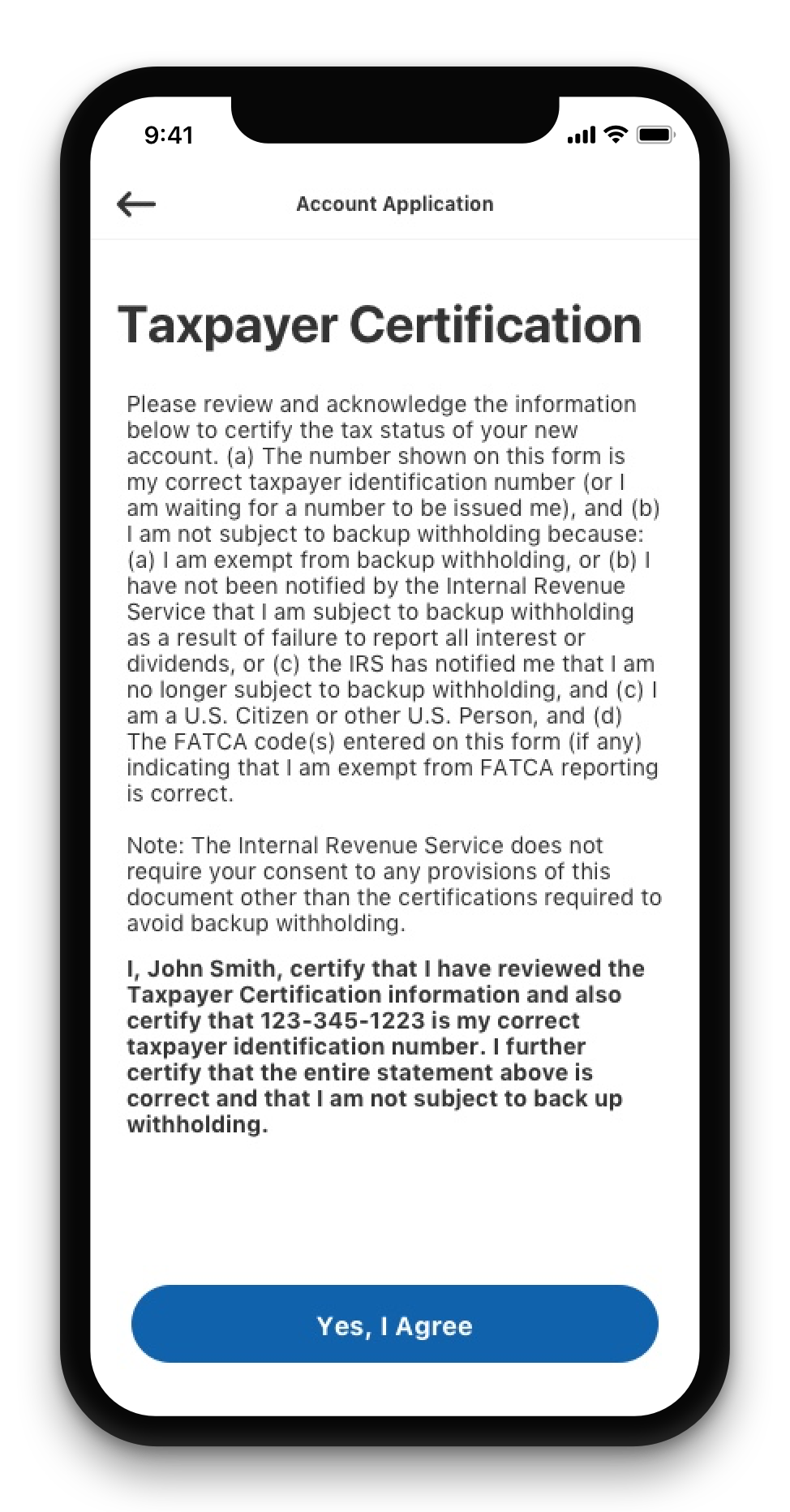

Create more conversational dialogue. Making the language easier to consume and understand. Breaking down the more complex financial language to be more of everyday language.

Opportunity #2

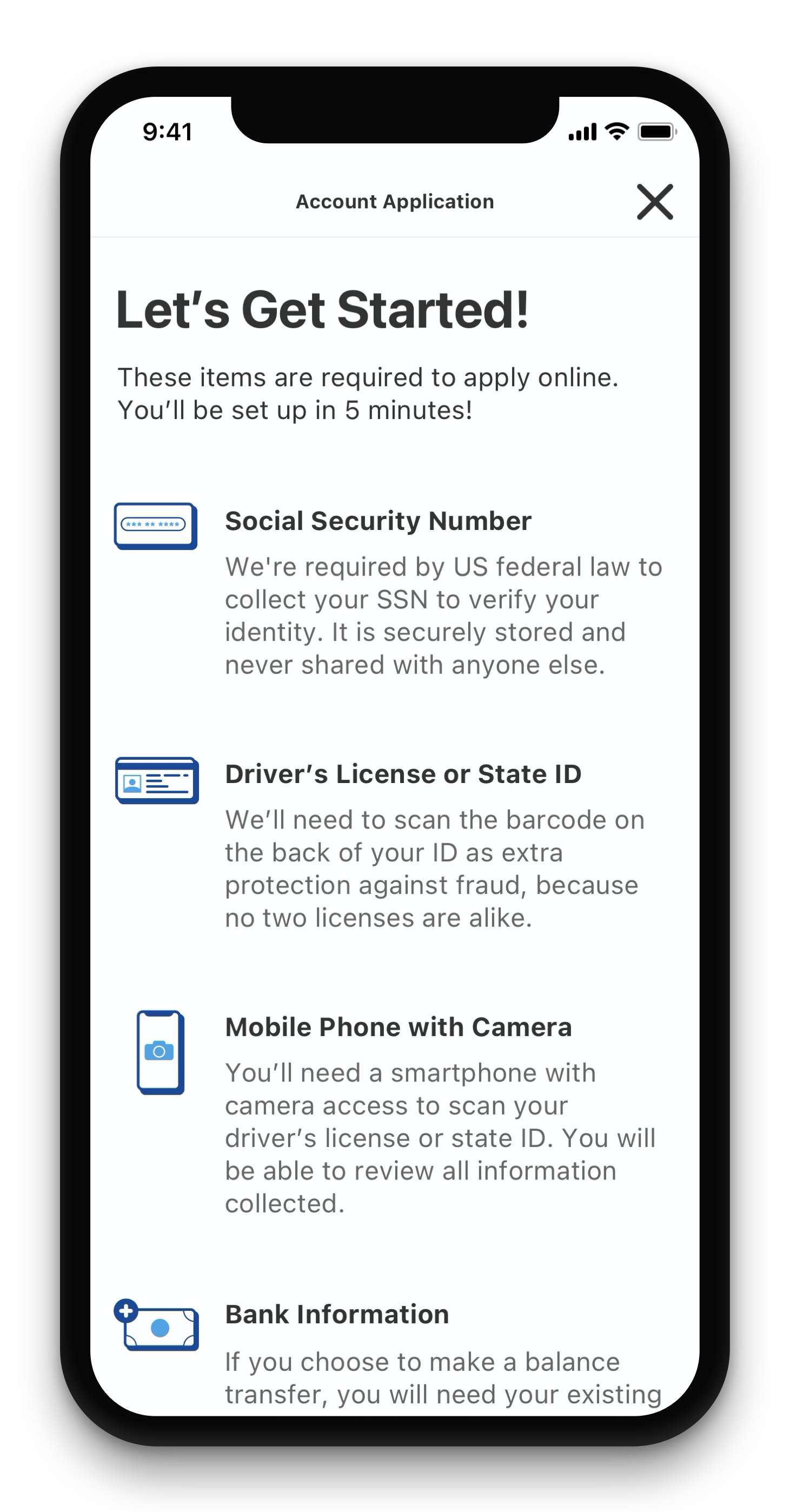

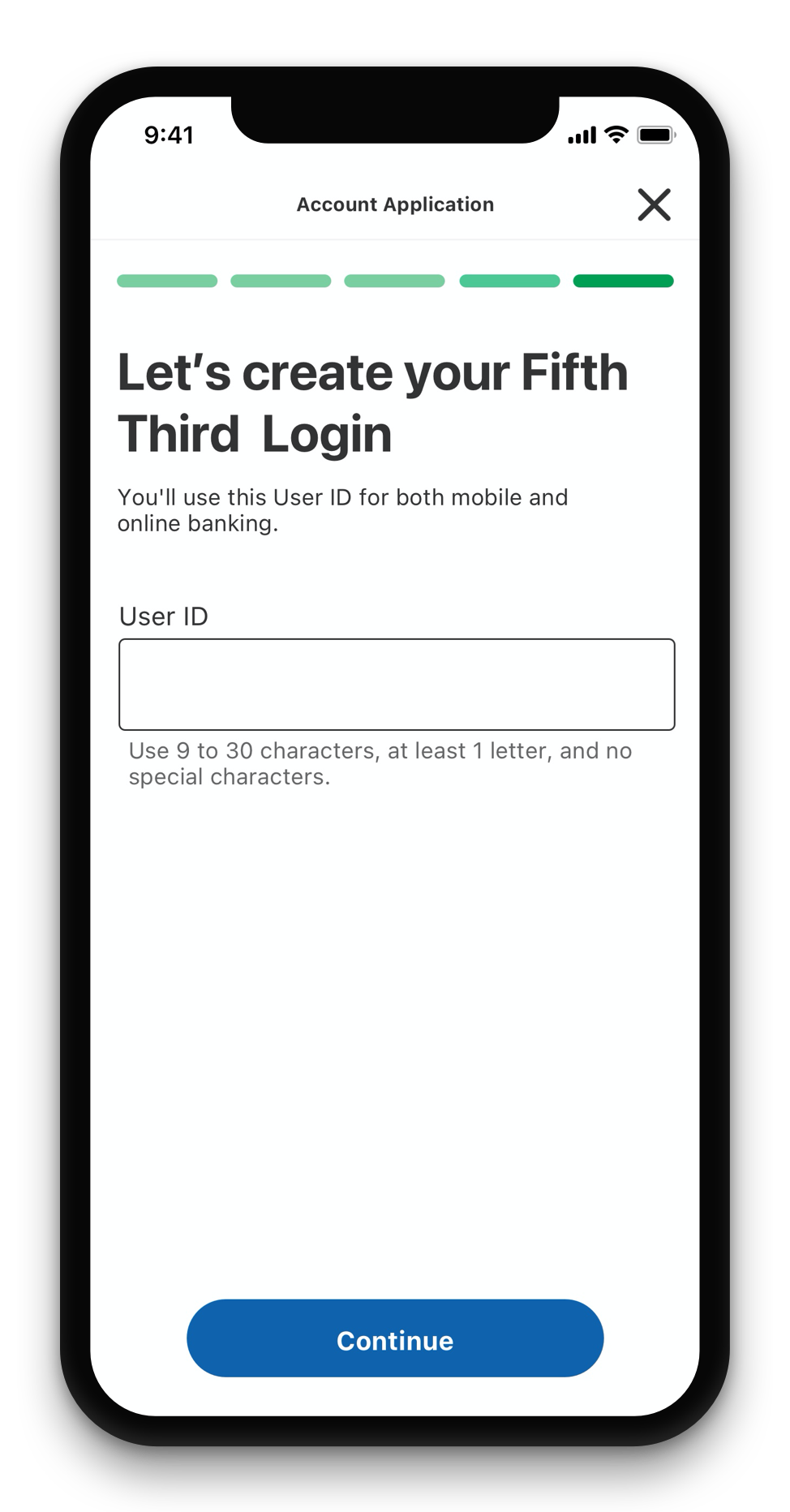

Creating a flow that is quick and easy for the user to move through. Informing the user upfront of time on task and the items they will need for a successful account application experience.

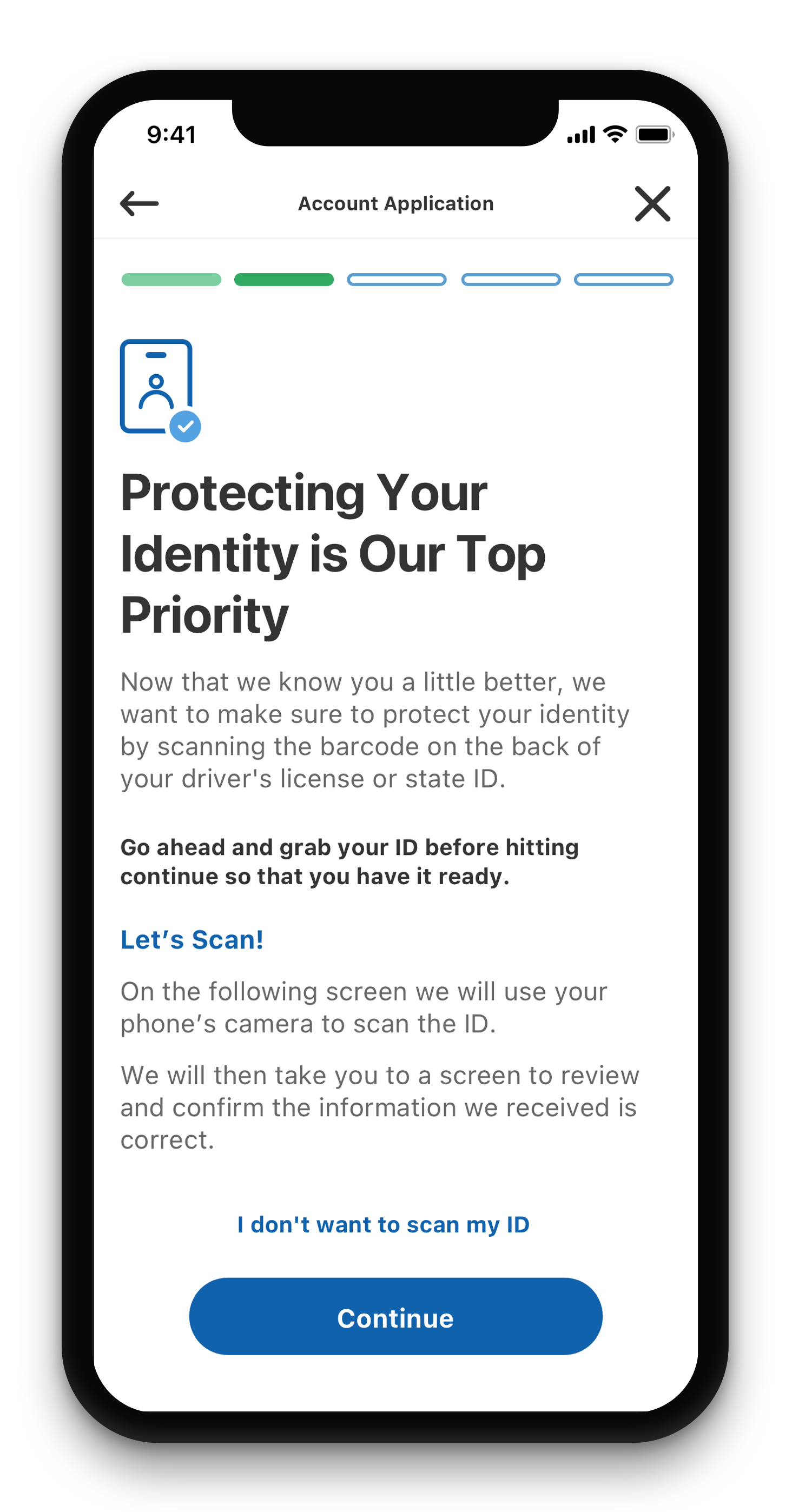

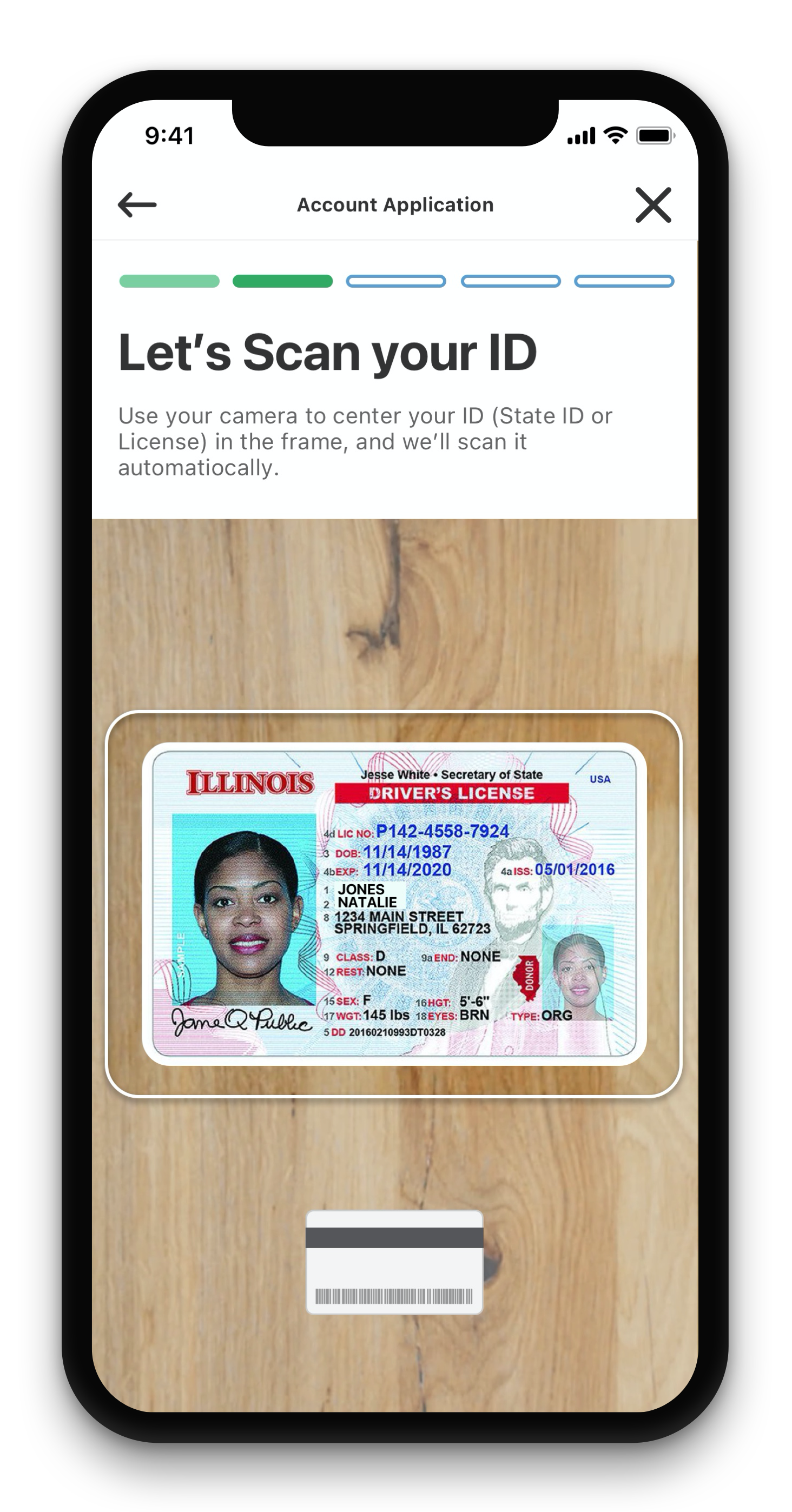

Opportunity #3

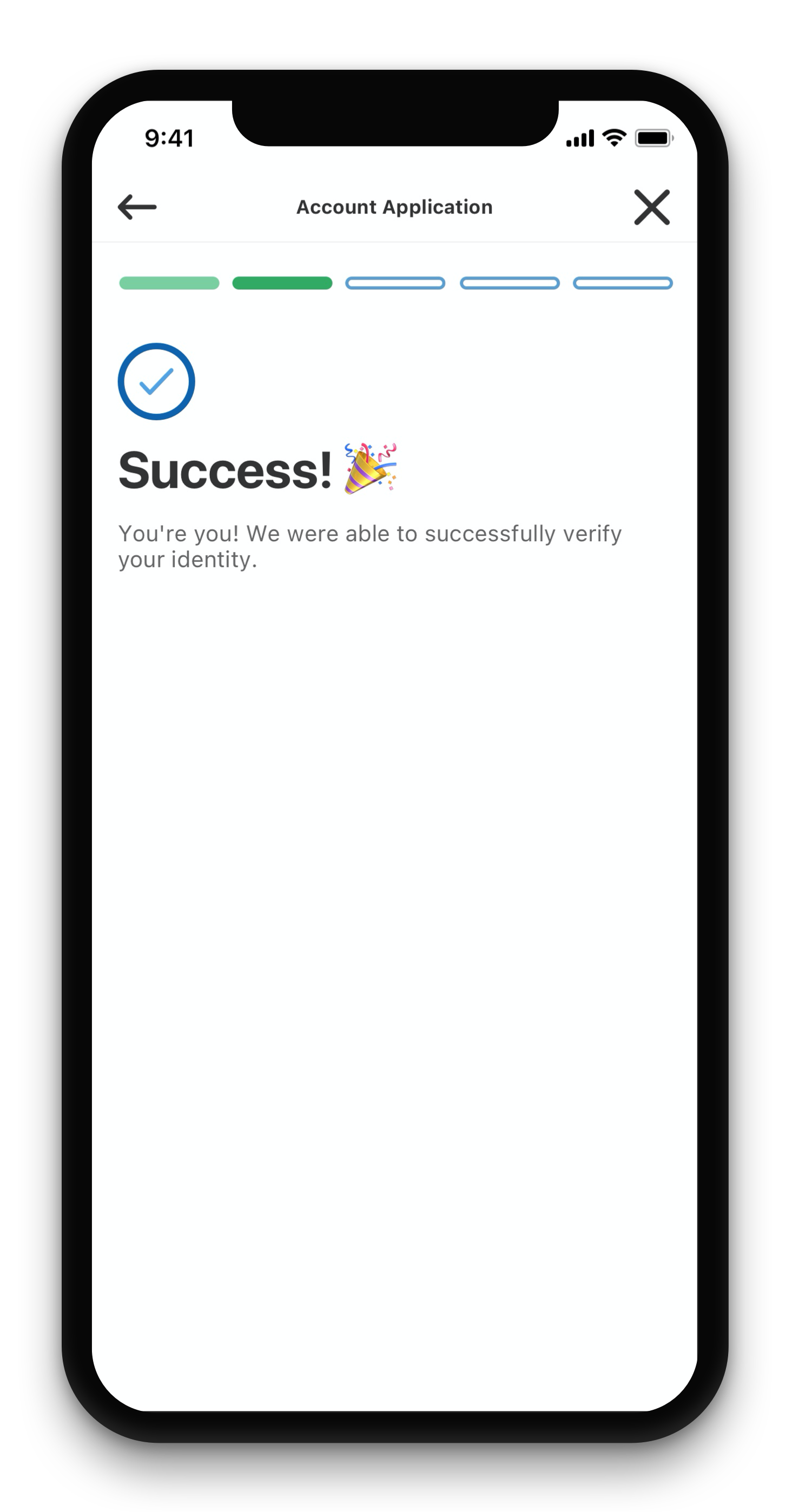

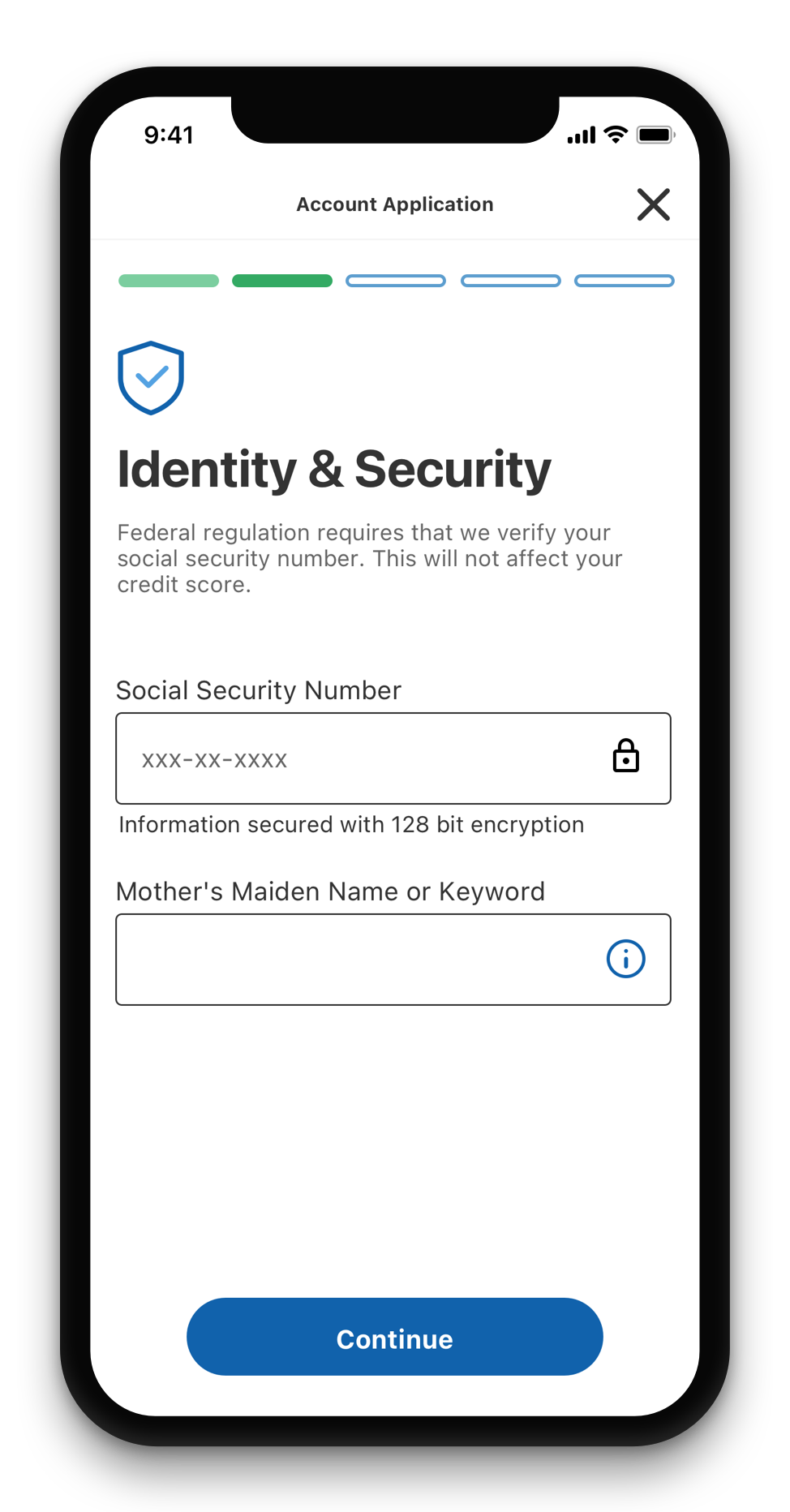

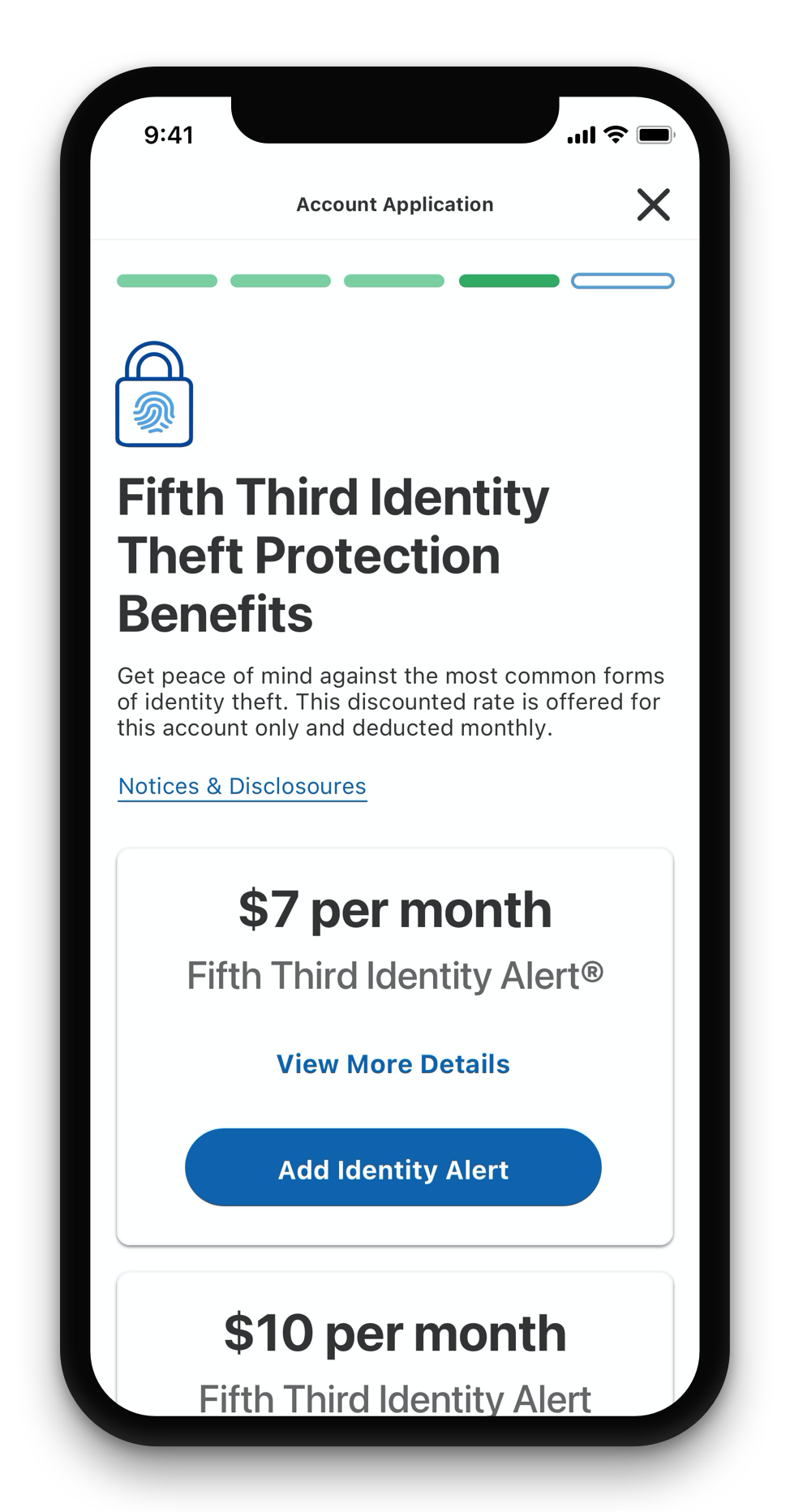

Create a feature that will allow the bank to be able to identify fraudsters while protecting users. A feature that will bring the user value and business value at the same time.

Opportunity #4

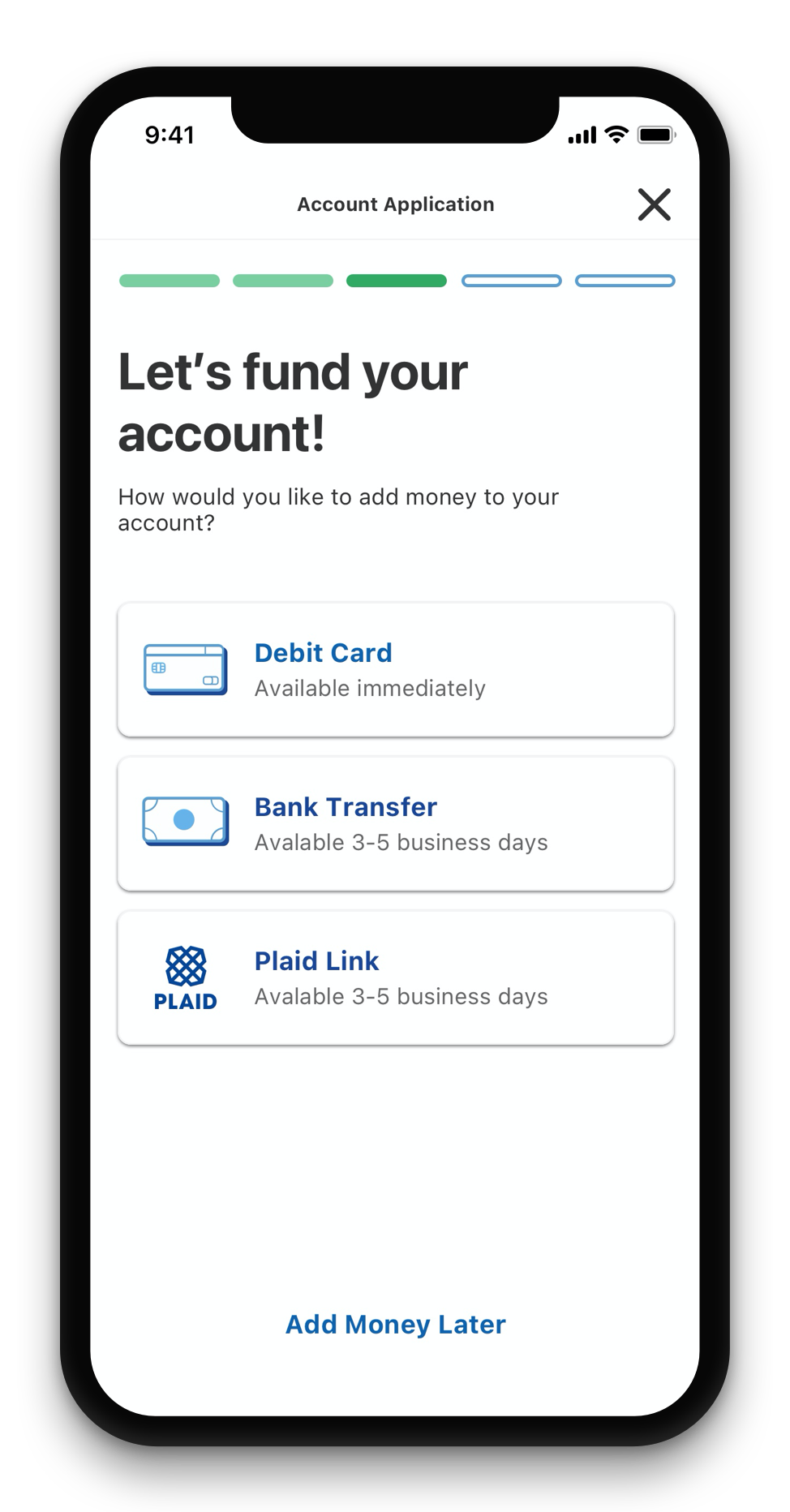

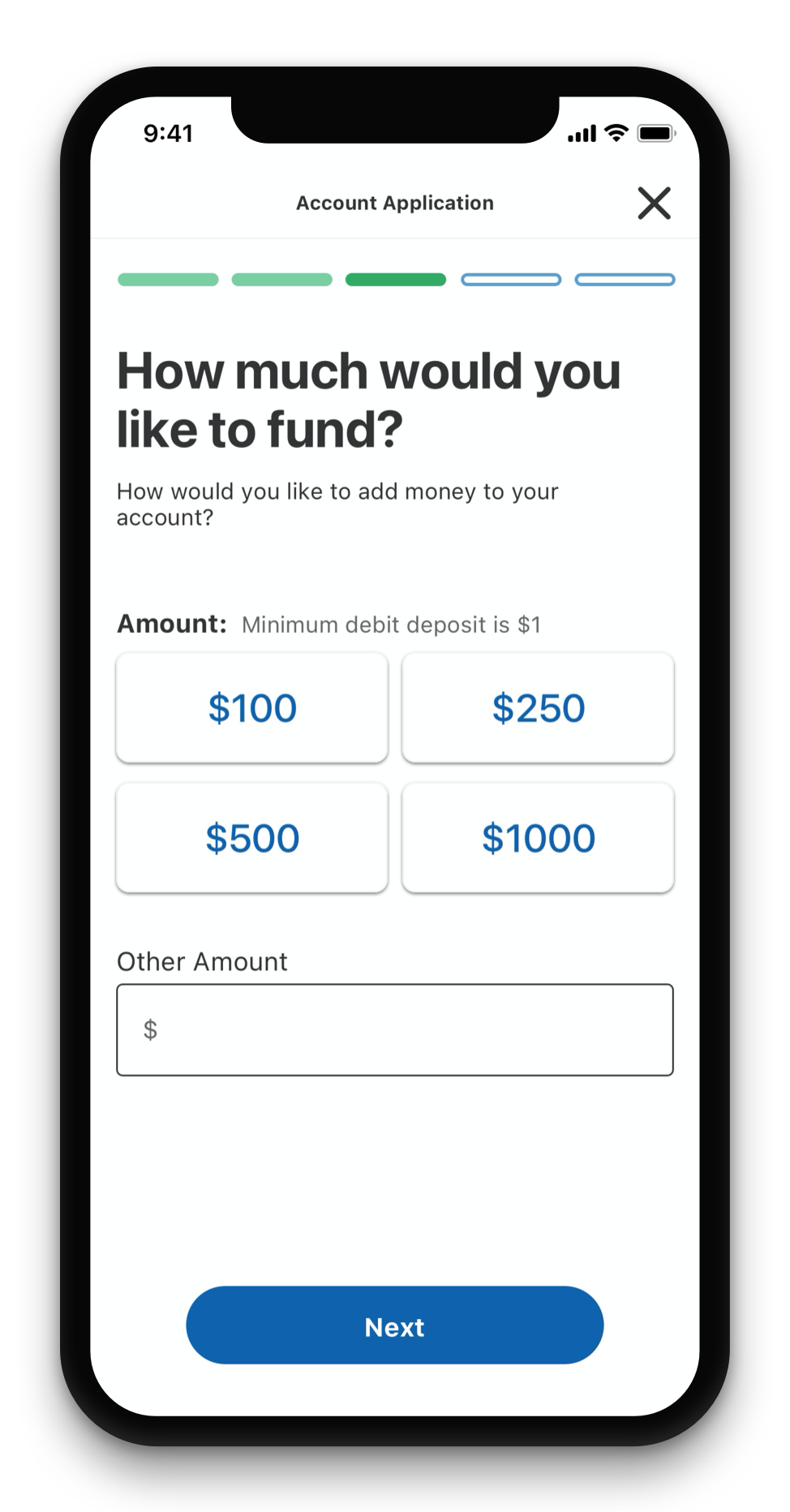

Create a funding experience that helps the users make better/easier decisions as to how much money they would like to fund their new account with. User’s often struggled with this decision point.

User Flows

Once we understood the opportunities and challenges we began to break the flow down into segments and tasks. Building out the user flow allowed us to see the path the users would take to achieve a successful account application. We also created user scenarios to understand what other paths the user may experience and documented them.

Design

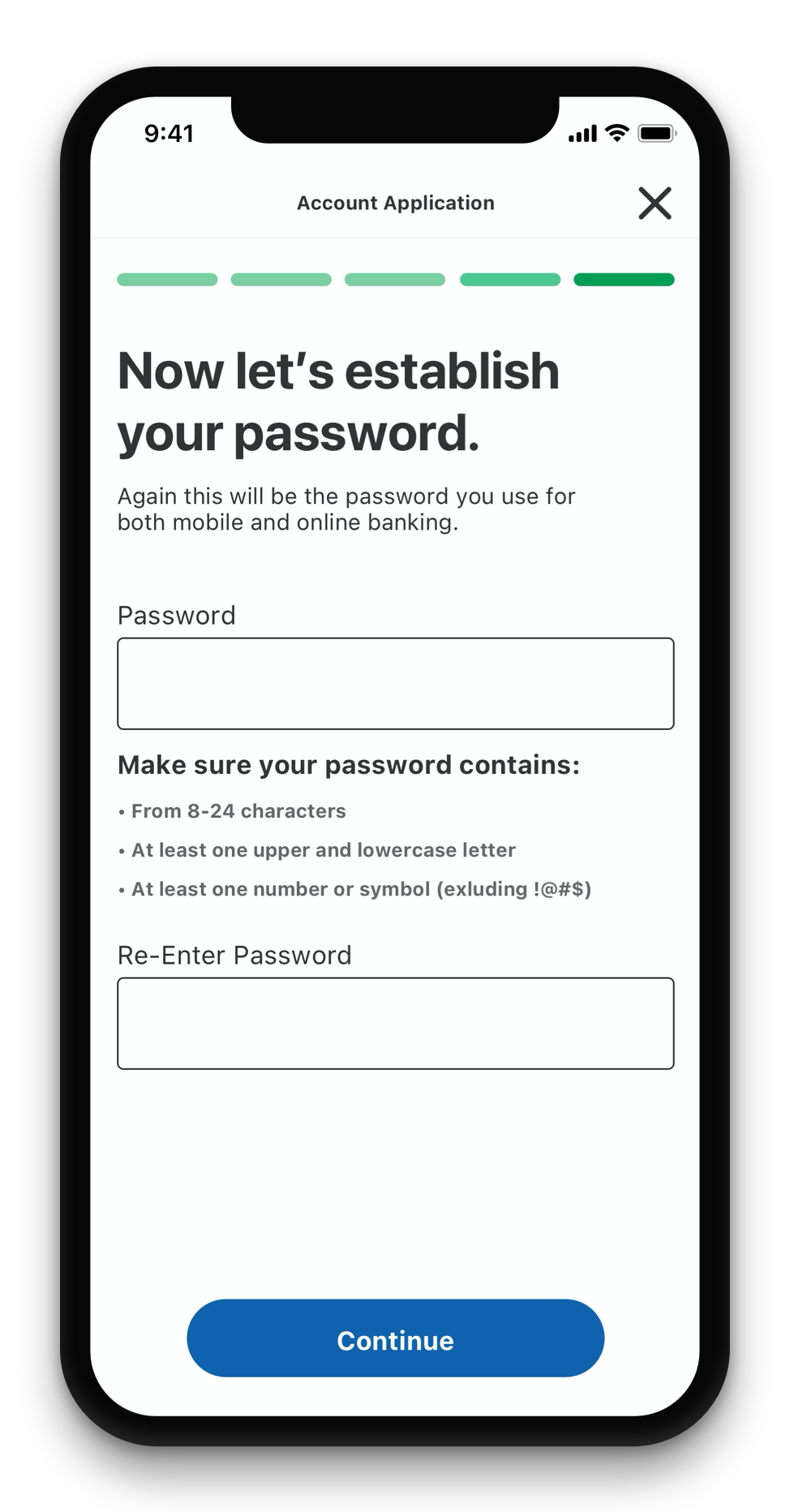

Wireframes

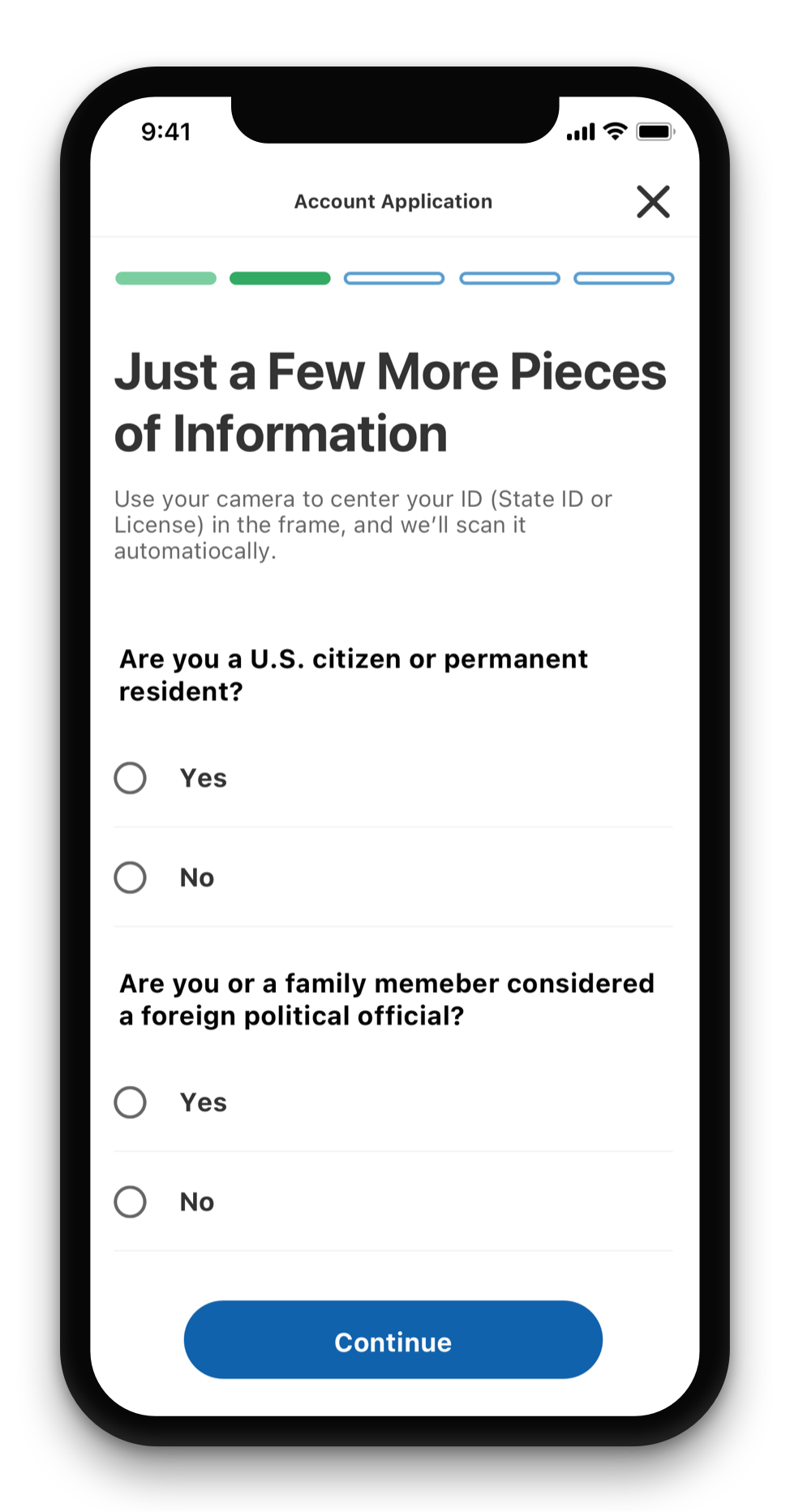

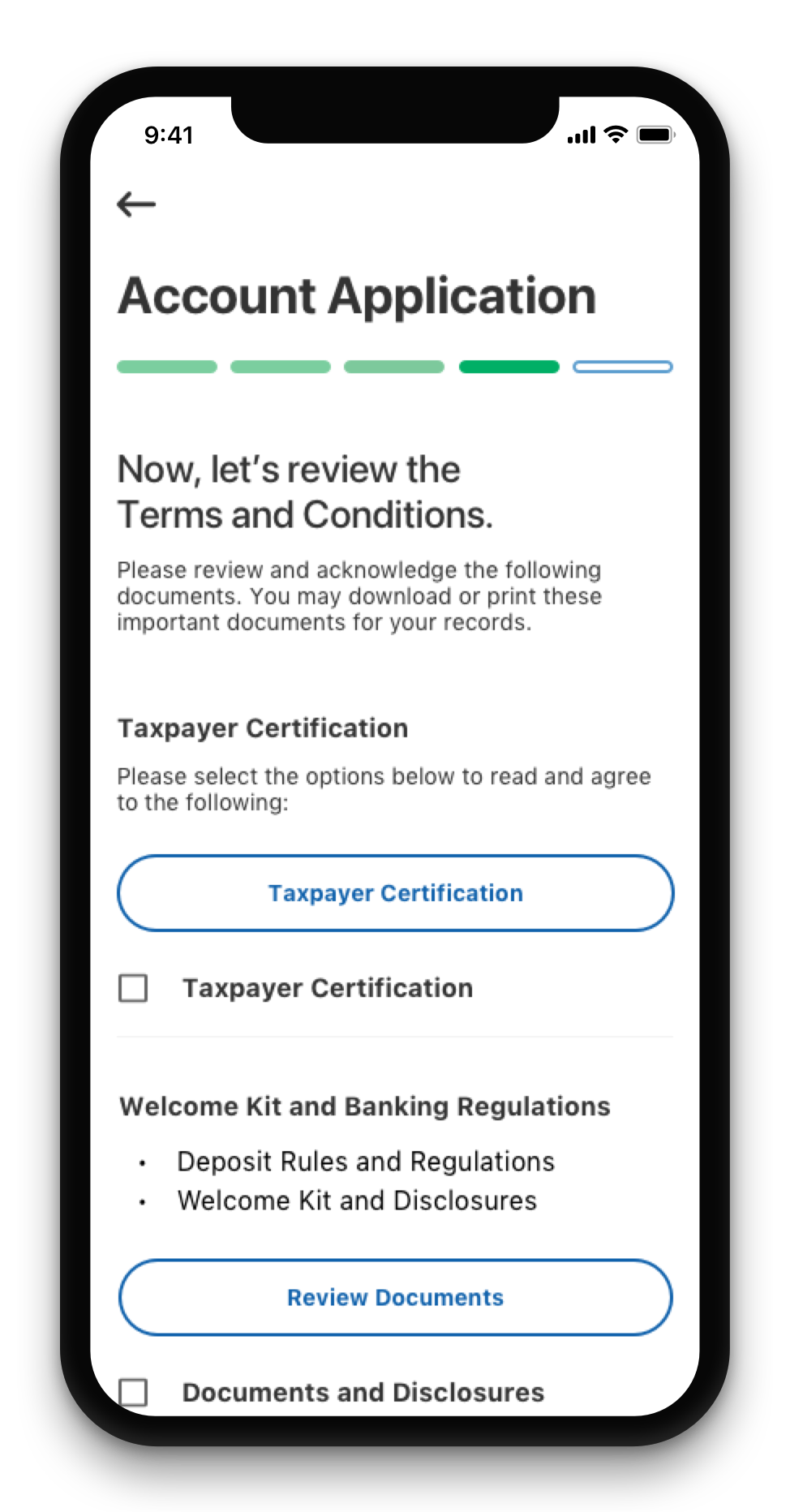

Create an account opening experience that simplified and streamlined the experience for the users while also helping to protect the bank from fraudsters opening accounts with stolen or fake IDs.

Usability Testing

For this usability session, we wanted to ensure that our new functions, features, and overall purpose align with what users want.

Objectives

• Understand user's perception of security.

• Understand user preferences concerning predetermined funding amounts.

• Feedback on the conversational language.

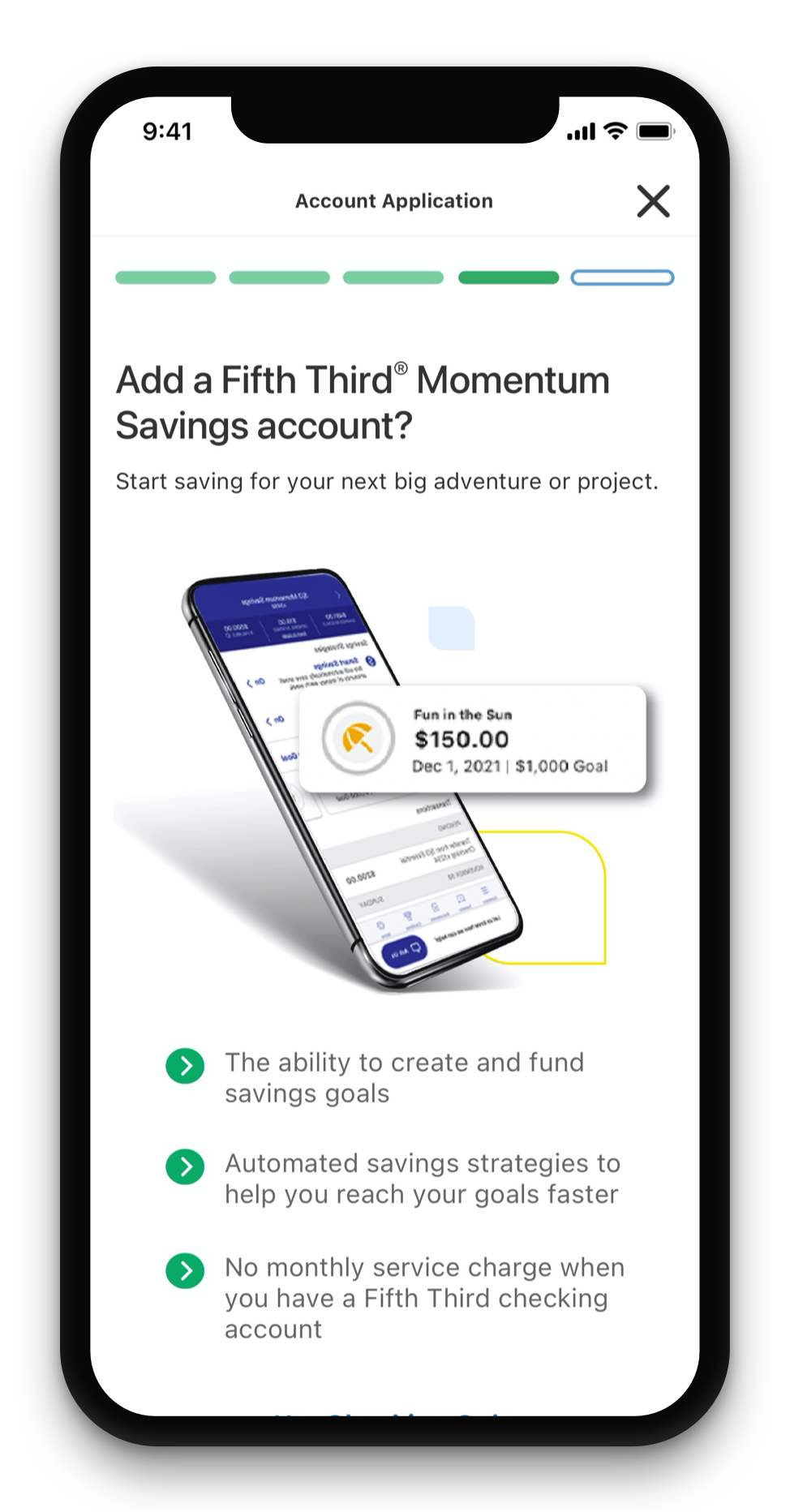

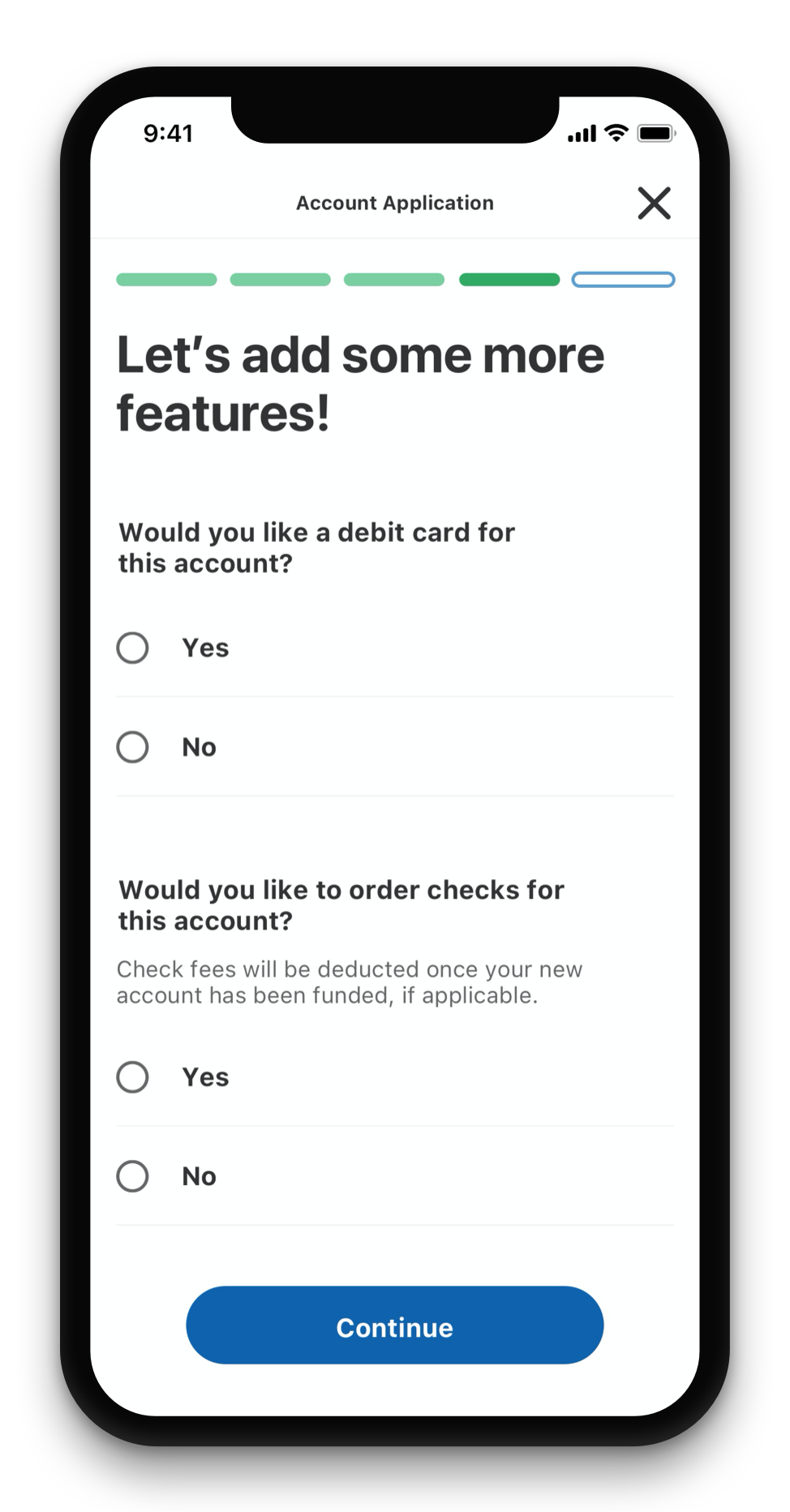

• Understand user's decisions when adding additional products to their application.

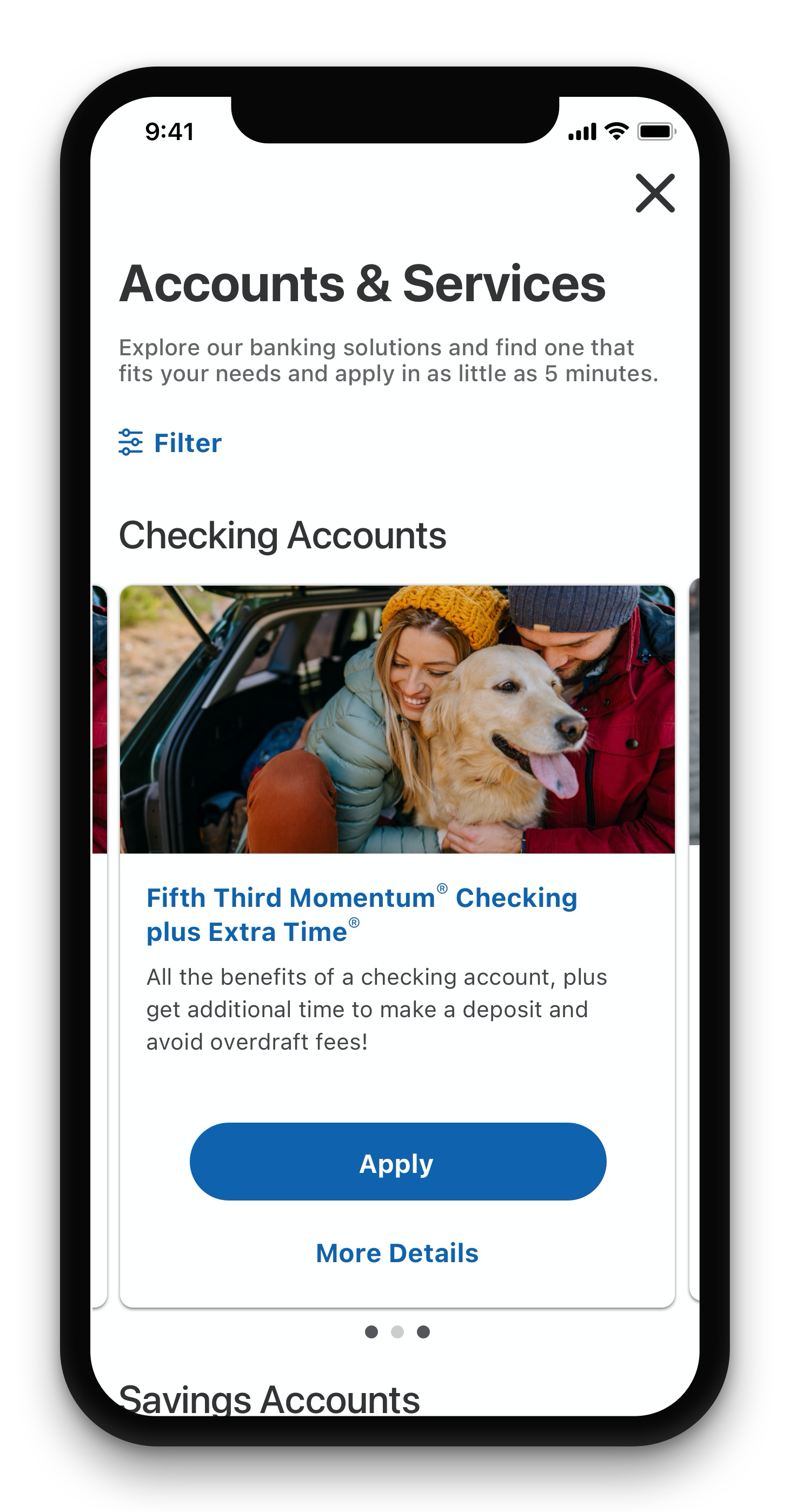

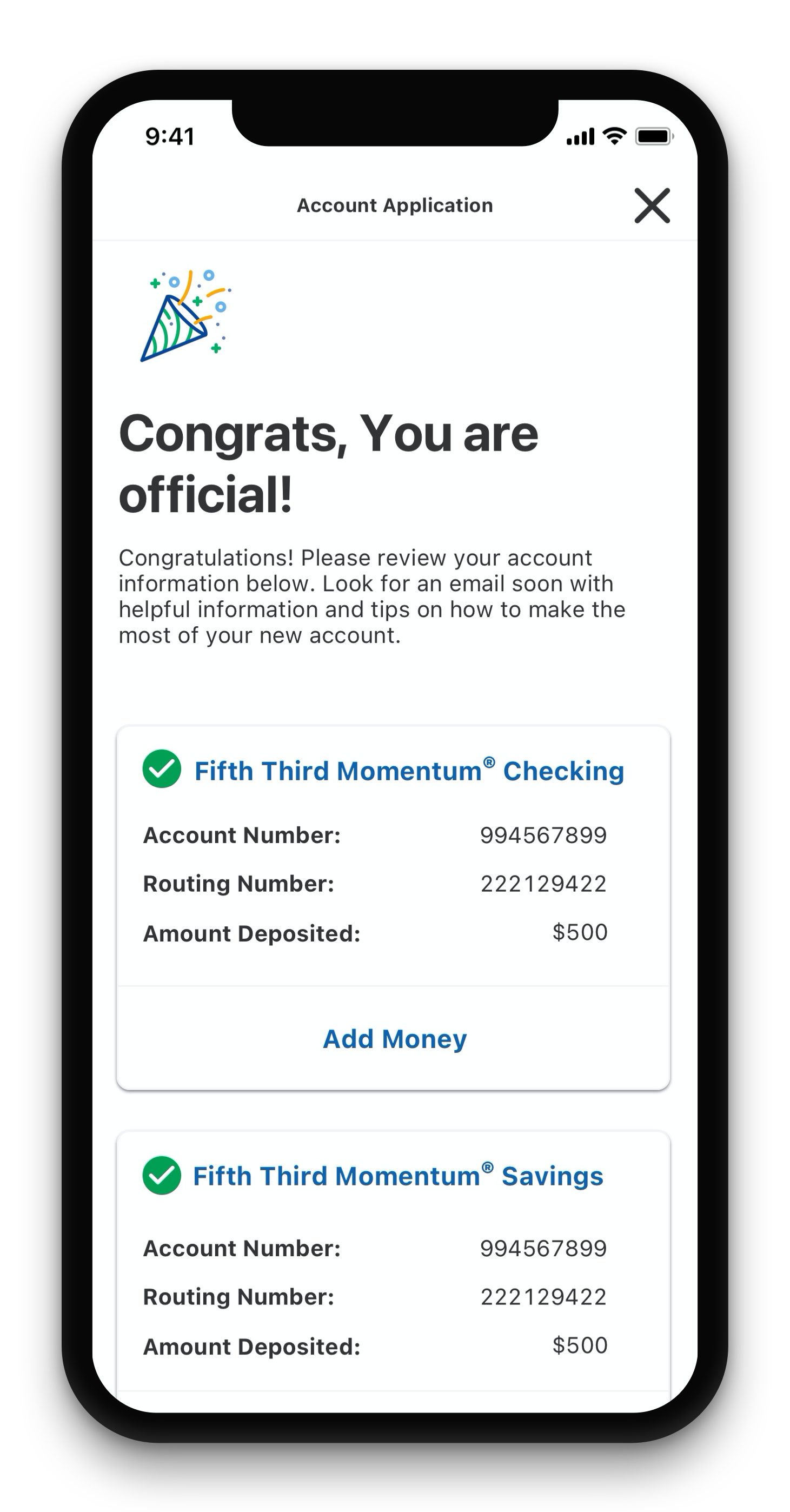

High Fidelity Comps

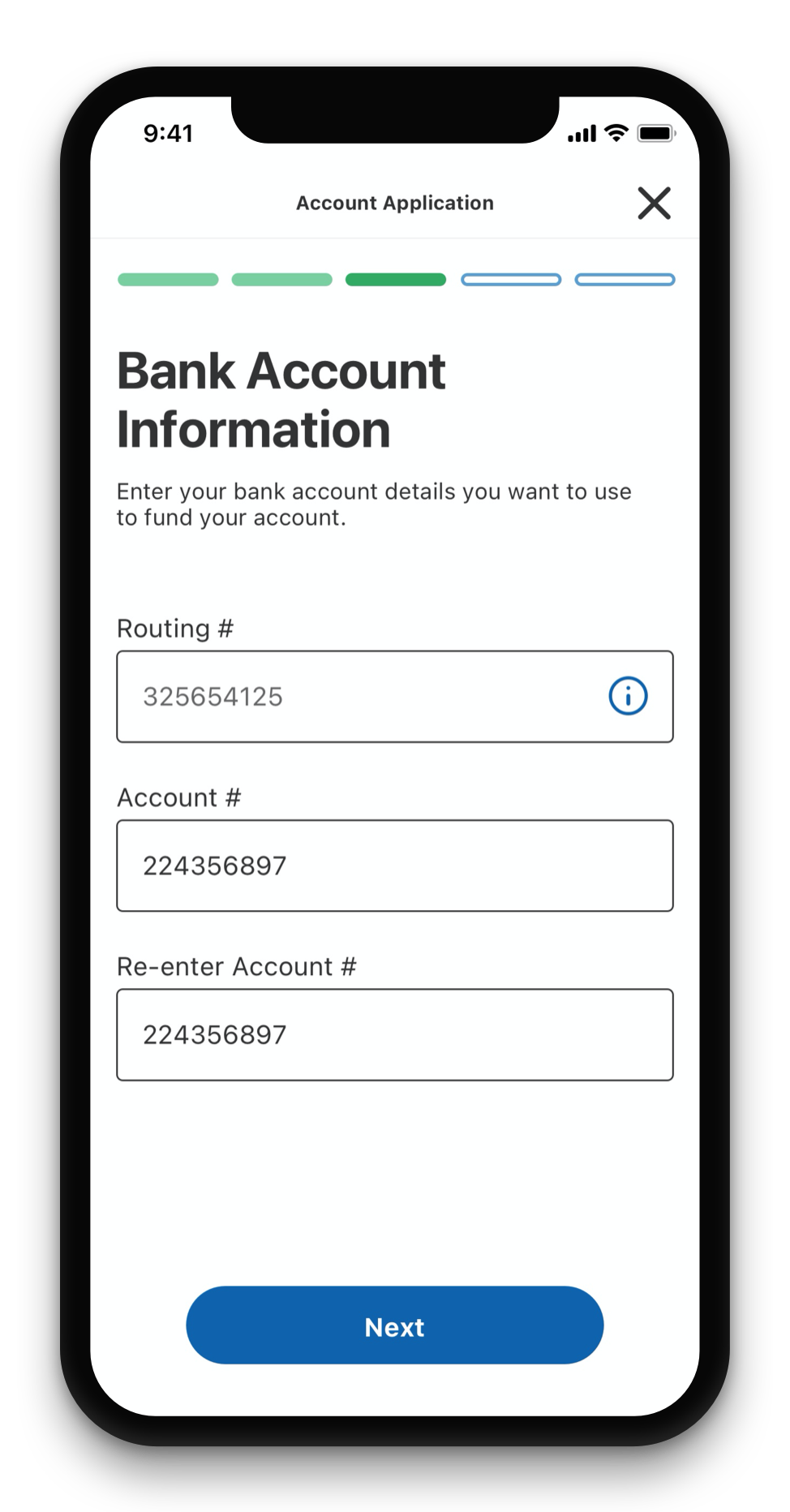

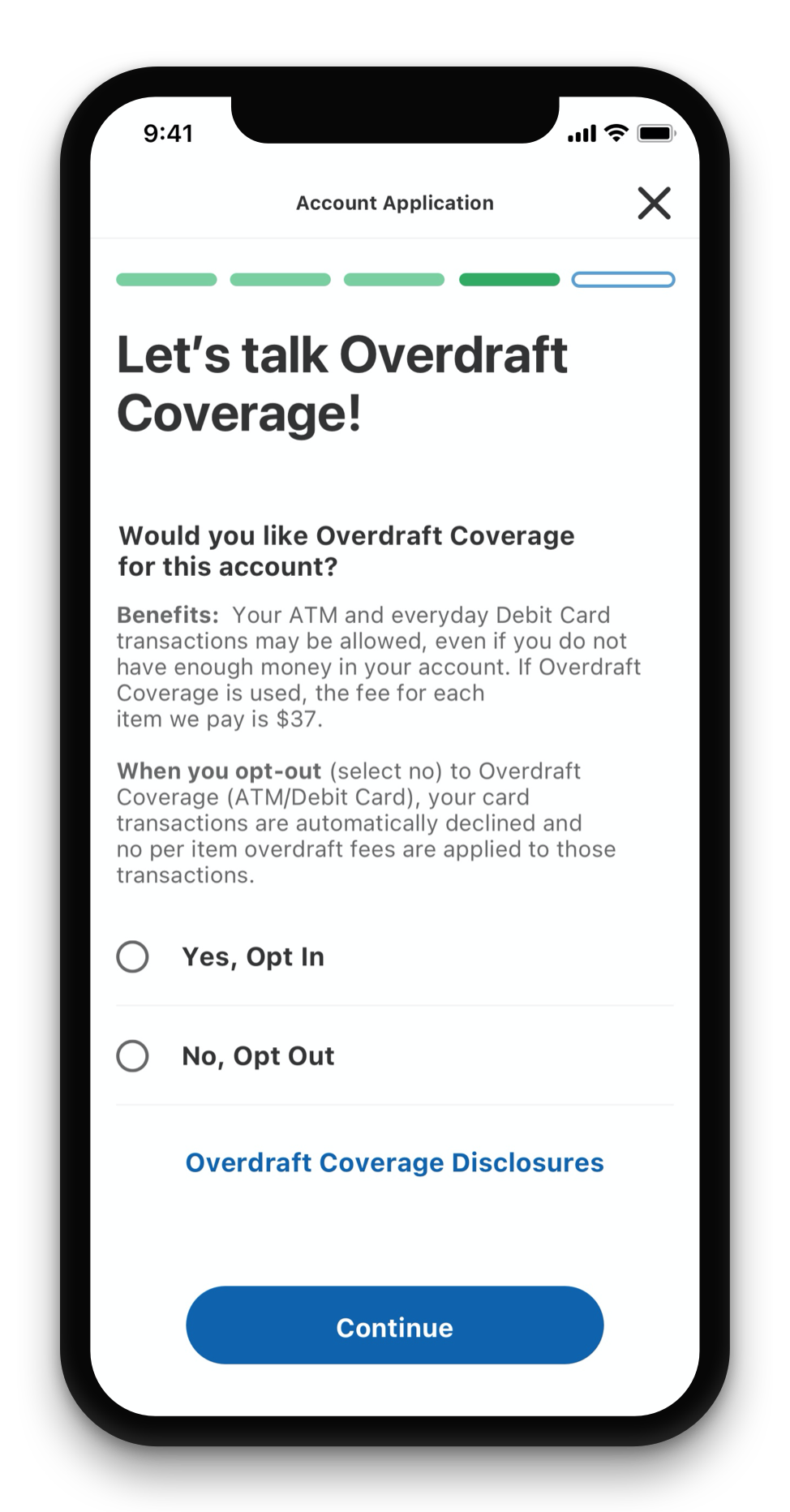

Utilizing the Fifth Third Design System and everything else we learned throughout the design process we created a prototype to socialize with our stakeholders and continue to test and develop.

OUTCOMES

01. Increased household adoption of digital account opening by 17%, meeting the 2021 goal by Q2.

02. Increased the funding rate of new accounts by 10%, surpassing the funding rates of in branch.

03. Decreased the amount of drop-off within the flow by 25%.

04. Decreased the number of fraudulent accounts opened by 75%.

05. Increased the amount of savings accounts opened alongside checking accounts by over 180%.